How US Banks Enabled Jeffrey Epstein's Spy Operation and The FBI Never Investigated His Death

Raskin’s letter and CBS forensics confirm the infrastructure behind Epstein’s intelligence operation.

Four major U.S. banks processed roughly $1.5B in suspicious transactions tied to Jeffrey Epstein over two decades, repeatedly failed to file required reports, and only reconstructed the trail after he died. At the same time, investigators arrived late to his death scene, failed to secure evidence, and later discovered missing surveillance footage. Taken together, the banking records and investigative lapses map the infrastructure of an intelligence asset, not ordinary criminal sloppiness.

What the Banks Reveal

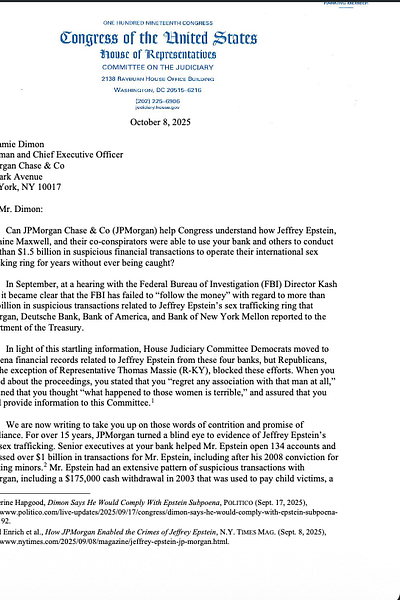

Rep. Jamie Raskin’s Oct. 8 letter to JPMorgan CEO Jamie Dimon asks the right questions—the ones a bank answers when it is servicing an operation, not a client. The records show:

Cash infrastructure for untraceable payments: JPMorgan enabled more than $5M in cash withdrawals, with routine $40–80k monthly pulls.

International wires through institutions in Russia, Belarus, Turkey, Turkmenistan, aligning with victim-origin countries.

Accounts in victims’ names opened and serviced by the bank.

Offshore vehicles to mask flows: Deutsche Bank’s “Butterfly Trust” moved $2.65M to women with Eastern European surnames for “tuition.”

Most telling is governance: when JPMorgan’s general counsel warned in 2011 that Epstein “should not be a client,”senior executives Mary Erdoes and Jes Staley kept the relationship alive. Staley exchanged ~1,200 emails with Epstein, referenced “Snow White,” and continued visits even after Epstein’s 2008 conviction. No SARs were filed during JPMorgan’s 15-year relationship or Deutsche Bank’s six; comprehensive filings came only after Epstein’s death. That’s not routine non-compliance—it’s operational support.

Read Raskin’s Letter In Full:

How the Death Scene Was Handled

CBS News’s forensic review underscores the same pattern: no evidence markers, no fingerprint or DNA work, multiple ligatures photographed in different places, a safe with labeled CDs documented but not seized, and later missing minutes from surveillance footage. Agents arrived hours late; core witnesses weren’t interviewed for two years. Those are not innocent mistakes; they are protective failures.

The Pattern We Reported Since 2019

While major outlets chased salacious detail, Narativ traced the intelligence architecture: Robert Maxwell’s legacy networks; Ehud Barak’s repeated meetings with Epstein; Iran-Contra money channels via Adnan Khashoggi; and a post-Cold War blend of Israeli military intelligence, Russian banking rails, and Wall Street offshore. Our reporting concluded that Epstein functioned as an Israeli military intelligence asset running a blackmail operation—and that U.S. institutions repeatedly protected the infrastructure around him.

What It Means

Evidence that should have closed the case keeps vanishing—financial records filed late, contents of the safe gone, edited footage, and executives who remain. It disappears because acknowledging the truth would expose not only crimes, but an allied intelligence architecture inside America’s largest banks.

Raskin’s letter and CBS’s forensics don’t break the story—they confirm the one we’ve documented for six years.