Jamie Dimon Has Some Explaining to Do About Epstein

JPMorgan’s CEO is blaming a single former executive for the bank’s Epstein relationship. The facts don’t support that story.

JPMorgan Chase processed $1.1 billion through Jeffrey Epstein’s accounts. Wire transfers to Russian banks. Payments to women in Belarus, Turkmenistan, and Turkey. Cash withdrawals of $300,000 at a time. The bank’s own compliance officers screamed warnings for years. The general counsel wrote that Epstein “should not be a client.” Anti-money laundering specialists flagged transaction after transaction.

And now, after Senator Ron Wyden demanded answers, JPMorgan Chase has offered America a scapegoat: one former executive, Jes Staley.

The bank wants you to believe that a single employee—however senior—orchestrated the entire relationship with a sex trafficker whose criminal enterprise moved more than a billion dollars through their systems over fifteen years. It’s an insult to basic intelligence.

Consider the timeline Wyden laid out. In 2006, Mary Callahan Erdoes, CEO of JPMorgan’s wealth management division, learned about Epstein’s suspicious cash withdrawals and sex crime charges. She kept him as a client. In 2011, after compliance officers and the bank’s general counsel explicitly warned her that Epstein showed signs of money laundering and human trafficking, she still took no action. That same year, she personally delivered a $9 million settlement check to Epstein’s Manhattan townhouse.

Two years later, in 2013, Erdoes finally confronted Epstein about his cash transactions. JPMorgan terminated him as a client. Then the bank sat on that decision for six years before filing a single suspicious activity report with federal regulators.

Six years

Federal law requires banks to flag suspicious transactions immediately—within 30 to 60 days. JPMorgan waited until 2019, after Epstein’s arrest made headlines, to file reports on 4,725 transactions totaling $1.1 billion. Those reports detailed payments that facilitated sex trafficking across international borders, including hundreds of millions processed through correspondent accounts at Russian banks that are now under U.S. sanctions.

The bank claims it didn’t know. The documents say otherwise. Internal emails show decisions about Epstein marked “pending Dimon review”—referring to CEO Jamie Dimon, who testified under oath that he never knew Epstein was a client until 2019. Yet his general counsel was reviewing Epstein materials “for Jamie” back in 2008.

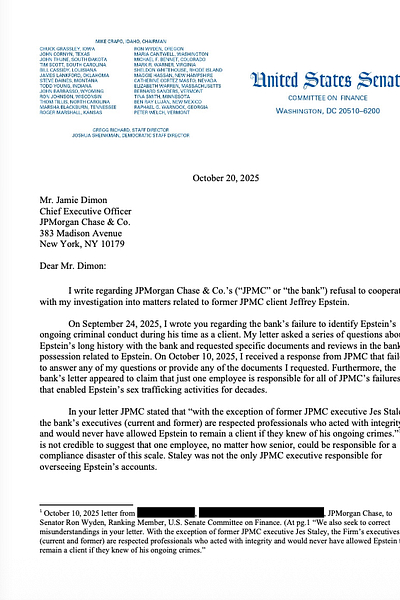

Wyden isn’t having it. His second letter to Dimon, released last week, demands the internal communications, the “Project Jeep” review JPMorgan conducted after Epstein’s second arrest, and every document related to why the bank waited six years to report transactions it knew were suspicious in 2013.

Paid subscribers can access a much deeper dive below