NEW ANALYSIS: The Us Economy Is On The Brink, And Urgent Action Is Needed

The repo market is flashing red, mortgages are buckling, and the players positioned to benefit - Crypto holders like the Trump Family. Democrats must act quickly.

The Great Recession of 2008, the financial crisis started with a slow leak—exotic mortgage-backed securities quietly rotting on bank balance sheets. When Lehman Brothers collapsed, the truth became undeniable: Wall Street had built an empire on quicksand. Millions lost homes, savings, and trust. The Federal Reserve rushed in with life support. The system teetered, but it survived.

Today, a similar fault line is rumbling beneath the surface. But this time, the collapse may not be a tragic accident—it may be a controlled demolition.

The 50% Offer comes to an end at midnight today

The Grim Repo

The alarm bell is ringing from a place most Americans have never heard of: the Federal Reserve’s “repo market,” short for repurchase agreements. This is Wall Street’s emergency liquidity room, where banks go overnight to borrow cash when they’re short. Think of it as the lender of last resort for the institutions that hold the global economy together.

What’s happening in that room right now should worry everyone.

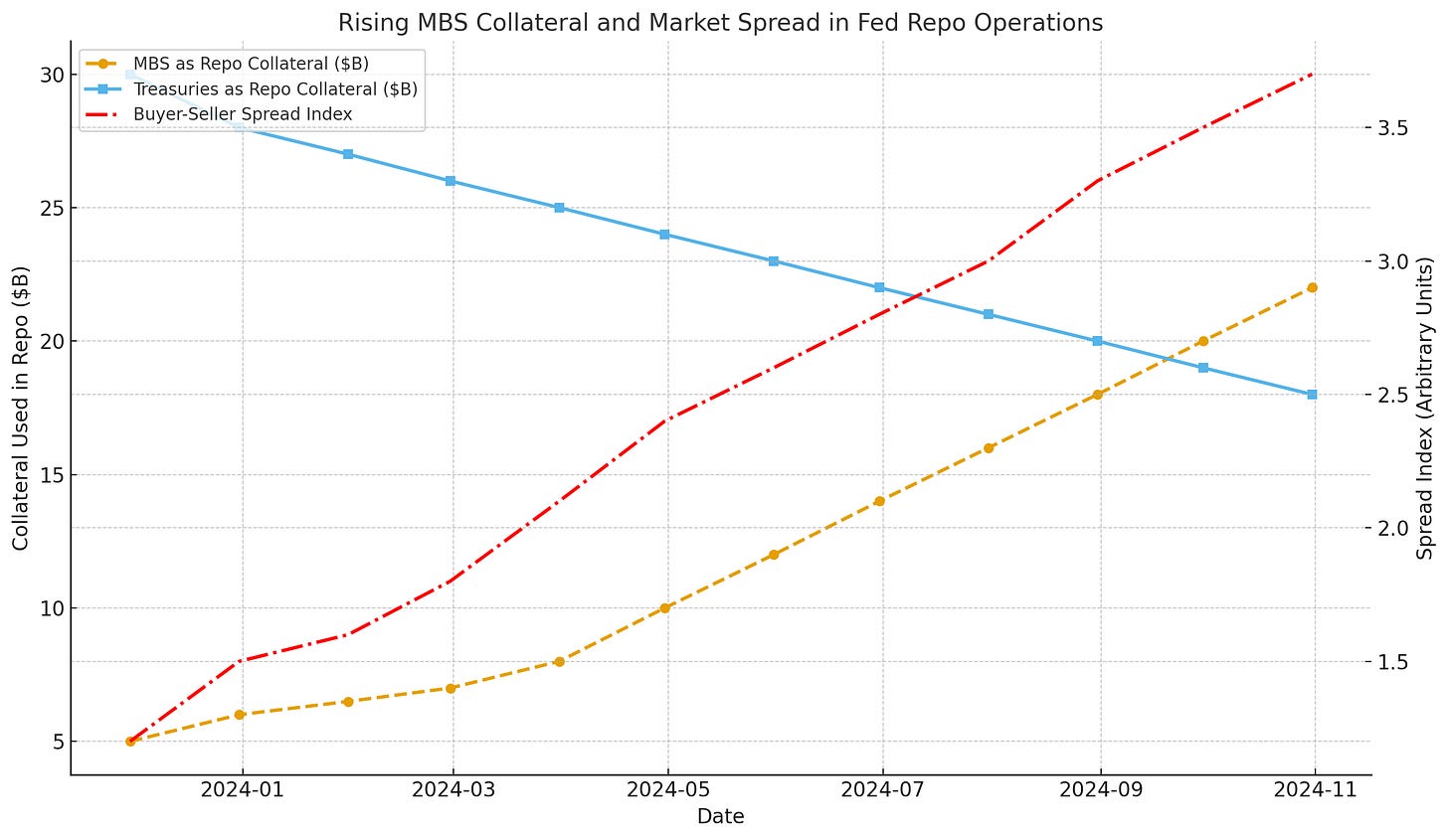

Over the last few weeks, banks have started bringing mortgage-backed securities—not U.S. Treasuries—as collateral to borrow from the Fed. That might seem like an obscure technical shift. It isn’t. Treasuries are the safest asset in the world—clean, trusted, easy to value. Mortgage-backed securities, by contrast, are debt instruments tied to homeowners—some of whom are now facing missed payments, job cuts, or vanished government assistance. For a bank to bring in a bundle of home loans instead of Treasuries means one of two things: either they’re running out of the good stuff, or they’re holding back for fear of what’s next. Neither bodes well.

By October 31st, banks had borrowed over $50 billion from the Fed in a single day—nearly half of it using mortgage debt as collateral. That isn’t routine liquidity. That’s a quiet scramble for cash.

And all of it is unfolding while the market itself shows signs of deep fracture. The spread between what buyers are willing to pay and what sellers are asking—the “bid-ask spread”—is now at record levels in sectors like real estate and credit markets. That’s a critical indicator. When buyers and sellers can’t agree on value, price discovery breaks down. In plain terms, no one knows what anything is really worth. This dislocation is what preceded the 2008 collapse. It’s what precedes all collapses.

The US$ Decline

But unlike 2008, the geopolitical backdrop today is a tinderbox. The U.S. dollar, once unquestioned as the global reserve, is under coordinated assault. China and Russia are trading in local currencies. BRICS nations are exploring alternatives. American debt is being offloaded by allies and rivals alike. Trust is eroding—not just in the currency, but in the entire postwar economic order it props up.

And into this void is flooding capital—from hedge funds, pension money, retail investors—toward cryptocurrency. Bitcoin is surging. Ethereum is climbing. Not because of innovation, but because of desperation. The traditional system feels rigged, fragile, unsustainable. In this environment, crypto is not just a speculative asset—it’s a lifeboat.

There’s more. For years, I’ve warned that the goal of certain political actors—especially those with heavy crypto investments—was to hollow out the U.S. financial system. To let the dollar collapse, or at least destabilize it, and create space for a decentralized alternative where they hold the power, the code, and the keys. For a long time, that sounded paranoid. Today, it sounds like reality

Paid subscribers can access a deeper dive that explores how the Trump family is positioned to benefit from a collapse, and what can be done by the Fed and states to save the American economy.