NY Times Financial Bombshell Reveals a President Held Hostage By Crypto-Backers

President Trump's $2.9 billion cryptocurrency holdings—representing 40% of his net worth—can only be converted to real money if his policies weaken the US dollar.

This story is available without a paywall as a public service.

Our Special July 4 Flash Sale Is On For One Week!

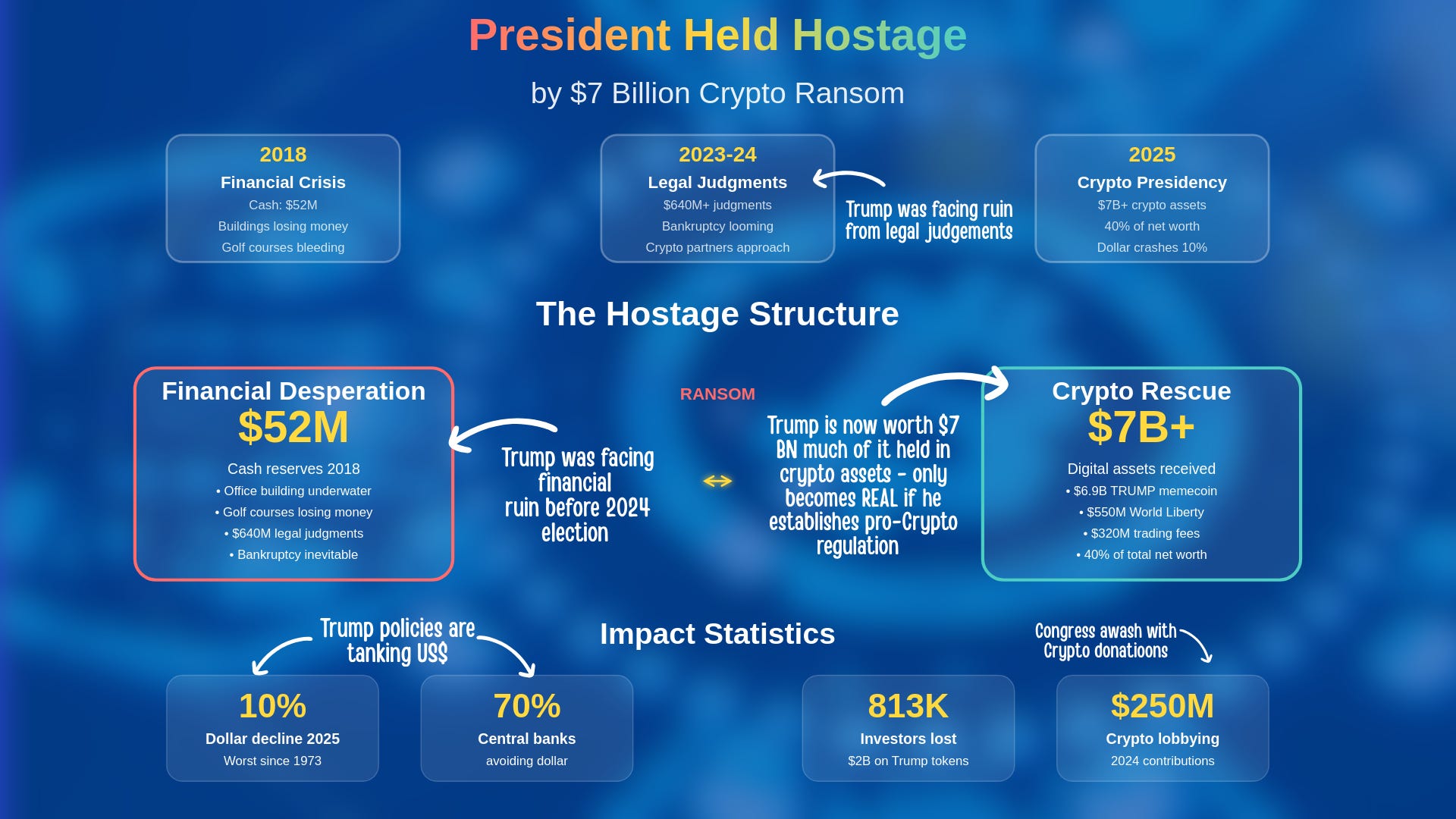

The New York Times today published bombshell revelations about the president’s financial health before and after his election. They reveal a portrait of the president facing financial ruin held hostage by crypto interests, through a cleverly engineered rescue scheme that only materializes if he passes specific policy initiatives that could collapses the US Dollar.

The perfect hostage situation: a financially desperate president whose personal survival depends on delivering policies that undermine the dollar and legitimize their digital empire.

NY Times documents expose the financial desperation

Previously unreported internal Trump Organization documents filed in the fraud case reveal the stunning scope of Trump's financial crisis before crypto intervention. The Times analysis destroys Trump's public claims of building a "steady and strong empire," instead exposing business failure across his entire operation.

The most damaging revelation: Trump's cash position collapsed to exactly $52 million in 2018—catastrophically inadequate for an operation of his scale. His flagship Manhattan office building at 40 Wall Street generated $2 million per year less than required for mortgage payments, while maintaining 25% vacancy rates that made refinancing nearly impossible.

The Times documents prove at least half of Trump's golf courses reported negative cash flow for multiple years, requiring constant cash infusions rather than generating profits. An internal email showed company finance chief Allen Weisselberg notifying Trump's sons that the entire Trump Organization produced only $2.2 million in 2017 before taxes—largely because golf courses spent $13 million more than planned while generating $15 million less than projected.

Most critically, the Times reveals Trump's improved cash position resulted not from business success but from desperate asset liquidation and a single $150+ million payout from a passive investment. Without these emergency measures, his financial position would have been catastrophic even before the $640+ million in legal judgments threatened complete ruin.

These internal documents prove crypto backers weren't approaching a successful businessman—they were rescuing a financially desperate politician whose empire was collapsing.

A bribe-in-waiting

What crypto backers created transcends traditional corruption. Rather than simple cash-for-favors, they built a dependency structure where Trump's financial survival requires delivering specific policy outcomes. Through memecoins, World Liberty Financial tokens, and strategic partnerships, they placed over $7 billion in digital assets within Trump's reach—but structured these holdings so they remain worthless without comprehensive crypto legitimization.

The $TRUMP memecoin exemplifies this sophisticated bribery. Its $6.9 billion theoretical value exists only if regulatory frameworks treat cryptocurrency as legitimate legal tender. Similarly, World Liberty Financial's $550 million in token sales granted Trump's family 75% of net revenues, but these revenues materialize only if crypto deregulation succeeds. The brilliance lies in making Trump's billionaire status contingent on delivering the exact regulatory outcomes crypto backers require.

This inverted bribery model makes policy delivery a prerequisite for wealth realization, ensuring Trump's personal interests align with crypto industry objectives—even when those objectives conflict with American economic sovereignty.

Dollar destruction accelerates by design

The pathway to crypto legitimacy requires undermining dollar dominance, and Trump's policies achieve this goal. The dollar's 10% decline in 2025 represents its worst performance since 1973, driven by what Federal Reserve Chair Powell acknowledges as tariffs "significantly larger than anticipated." These policies have triggered what Deutsche Bank describes as a "crisis of confidence" in dollar assets.

International confidence has collapsed: 70% of central bank reserve managers now avoid dollar investments, up from 35% just one year ago. This creates precisely the instability crypto alternatives need to gain legitimacy. As traditional financial confidence erodes, alternative currencies become not just viable but necessary for global commerce.

Congress Buys Into The Scheme

The crypto industry's $250 million in campaign contributions transformed Congress into a legislative assembly for digital asset interests. Three bills advancing through the Capitol directly serve Trump's crypto empire:

The GENIUS Act passed the Senate 68-30, creating federal stablecoin frameworks that could expand the market to $3.7 trillion by decade's end—directly multiplying the value of Trump's World Liberty Financial ventures.

The FIT21 Act passed the House 279-136, ending the SEC's enforcement approach that previously constrained crypto markets while creating safe harbors for DeFi activities—removing the primary regulatory barrier to Trump's platform monetization.

The BITCOIN Act proposes acquiring 1 million Bitcoin for a Strategic Reserve, positioning cryptocurrency alongside gold as a government-backed asset. This provides the ultimate legitimacy needed to dramatically increase Trump's crypto holdings while using taxpayer funds to create his exit strategy.

Every major crypto bill advancing through Congress directly benefits Trump's digital empire, creating the exact regulatory framework necessary to convert his ransom payments into liquid wealth.

Market manipulation and foreign influence

Trump's March announcement naming five cryptocurrencies for strategic reserves caused immediate 20-25% price spikes, adding $300 billion to crypto market cap within hours. Blockchain analysis revealed wallets funded with millions purchased 6% of $TRUMP supply within 90 seconds of launch—classic insider manipulation.

The human cost proves staggering: 813,294 wallets lost $2 billion trading Trump tokens while insider groups profited $170 million in two days. For every dollar Trump entities earned, ordinary Americans lost twenty.

Foreign entities appear to be purchasing influence through crypto channels. Justin Sun, facing SEC fraud charges, invested $75 million in World Liberty Financial before charges were dropped. Chinese firm GD Culture Group announced a $300 million $TRUMP purchase during TikTok negotiations—suggesting untraceable foreign influence operations.

Adversary alignment

Trump's crypto policies align seamlessly with adversary strategies designed to end American financial hegemony. Russian oil settlements increasingly use Bitcoin to circumvent sanctions. China's digital yuan creates dollar-free trade corridors. BRICS nations develop gold-backed cryptocurrency platforms explicitly designed to bypass U.S.-controlled financial infrastructure.

The fate of great empires rests on the stability of their currencies. The dollar's seven-decade dominance reflected American economic supremacy, but now the president’s crypto and tariff policies are conspiring to dethrone the dollar and threaten US hegemony.

Historical warning

History demonstrates that political leaders manipulating currency for personal gain trigger economic catastrophe and democratic collapse. Rome's currency debasement began with Nero and ended with hyperinflation that collapsed the empire. Weimar Germany's monetary manipulation enabled Hitler's rise through economic chaos. Modern examples include Zimbabwe's economic collapse under Mugabe and Venezuela's devastating contraction under Maduro.

Every case follows identical patterns: leaders facing pressure choose monetary manipulation over fiscal discipline, short-term gains precede economic catastrophe, and institutional destruction enables authoritarian capture.

The captured presidency

Trump's crypto holdings now represent 40% of his total net worth according to financial disclosures. His personal survival requires policies that actively undermine American economic sovereignty. Crypto backers achieved something beyond traditional influence: they created a hostage situation where presidential decision-making serves crypto industry interests regardless of national consequences.

The proposed congressional MEME Act prohibiting presidential cryptocurrency issuance represents belated recognition of this hostage scenario. However, with Trump's crypto ransom already operational and deregulation policies advancing through a captured Congress, containing this threat requires immediate action before dollar confidence erodes beyond recovery.

The hostage scheme operates exactly as designed: a financially desperate president held captive by digital assets that can only be converted to real money by destroying American monetary sovereignty. The ransom demands are clear, the payment structure is operational, and American economic independence serves as collateral for presidential enrichment.

The republic's founders never imagined a president whose fortune would be held hostage by industries seeking to overthrow the very financial system he swore to protect. They designed checks and balances for corruption, not capture—and certainly not for a commander-in-chief whose personal wealth requires the destruction of American monetary sovereignty.