The Blackstone Shooting: The Official Story Doesn't Add Up

The football brain injury narrative doesn't stand up to scrutiny, but a targeted assassination does.

The official narrative about Shane Tamura's attack on Blackstone's Manhattan headquarters contains troubling inconsistencies that demand scrutiny. While we may never know what Wesley LePatner could have exposed in her position as BREIT CEO, the circumstances of her death—and the documented financial networks surrounding Blackstone—raise questions that extend far beyond workplace violence.

Story Does Not Pan Out

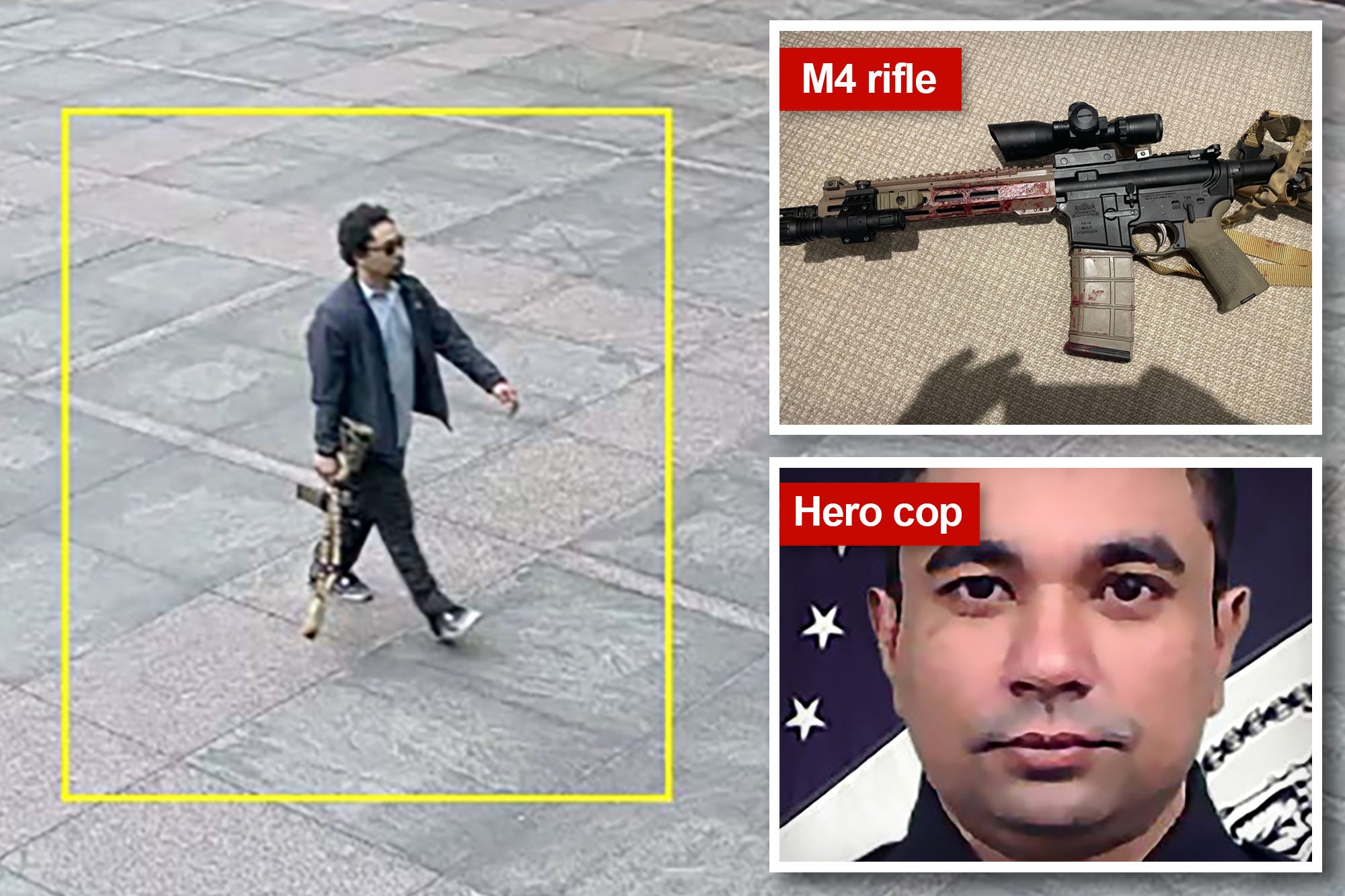

Mayor Adams claimed Tamura took the "wrong elevator bank" trying to reach NFL offices on the 5th floor but ended up on Rudin Management's 33rd floor. This explanation crumbles under basic scrutiny. LePatner was shot in the lobby immediately upon Tamura's entry—before any elevator confusion could occur. Security footage reportedly shows her hiding behind a pillar when killed, suggesting she was targeted within seconds of his arrival.

The supposed CTE motivation doesn't hold up either. Former teammates describe Tamura as someone "You never would have thought violence was something you'd associate with him." Even Mayor Adams admits the NFL connection doesn't pan out: "Those items just don't pan out. He never played for the NFL."

The attack pattern suggests tactical knowledge: neutralize security (the NYPD officer), eliminate primary target (LePatner), create diversion on different floor, execute suicide to prevent interrogation. This follows operational protocol, not the chaotic rampage of someone driven by brain injury delusions.

BREIT: The $53 Billion Vehicle Under Pressure

Blackstone restricted withdrawals from its $125-billion real estate investment fund BREIT (Blackstone Real Estate Investment Trust) due to a surge in redemption requests from investors in December 2022. By 2023, BREIT paid $1.4B out of $3.9B in February redemptions, fourth month in row withdrawals blocked.

This wasn't just market volatility. BREIT's structure as a non-traded REIT allows it to maintain valuations that defy market realities. While public REITs crashed, BREIT maintained artificially stable pricing—raising questions about how private equity uses opacity to shield investors from losses while attracting new capital.

The largest player in the wealth space is Blackstone, which has four large open-ended, or evergreen, funds that lets individuals invest in real estate, private credit, private equity and infrastructure. These products specifically target accredited investors and qualified purchasers—precisely the demographic that includes foreign nationals and entities seeking to move money through U.S. markets.

Paid subscribers gain access to our deep dive that includes the documented financial networks connecting Blackstone, Apollo, and Russian capital flows that Wesley Lepatner would have had access to as BREIT CEO.