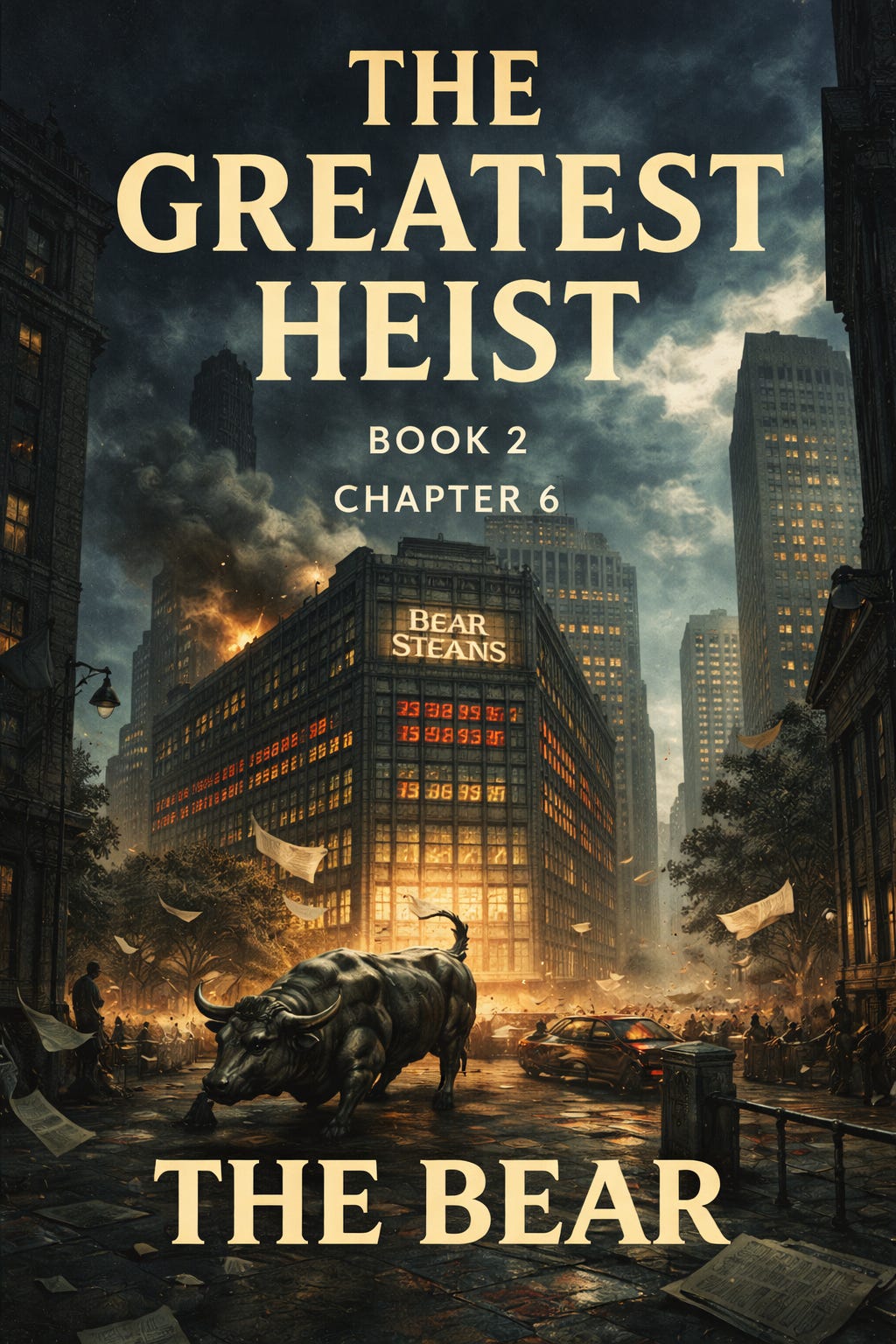

THE GREATEST HEIST BOOK 2 | Chapter 6 The Bear

The Greatest Heist in History Began with a Single Call.

To understand the greatest heist in history, you have to understand unfettered greed.

Not the garden-variety kind. The voracious appetite that causes an animal to gorge on food until it can’t eat anymore—and yet keeps consuming everything around it. The kind of avarice that doesn’t stop when it’s full. That can’t stop. That won’t stop until there’s nothing left.

It’s in that mindset we find ourselves in the Manhattan of the early 2000s. An orgy of consumption built on something Wall Street called “financial innovation” but was really just predatory lending dressed up in mathematics.

Liar’s loans. Mortgages given to people who couldn’t afford them, with no documentation required, inflated appraisals, hidden fees, teaser rates designed to explode. Sold systematically to working Americans who trusted the system, who believed that if a bank offered them money, they must qualify for it. The evidence shows widespread fraud—incomes and assets routinely overstated, often by loan officers and brokers themselves, making these loans 5 to 8 percentage points more likely to default than fully documented mortgages.

Once these bad loans were made, Wall Street bundled them together and sold them as investments. This let the banks dump the risk onto someone else and go right back to making more bad loans. In fact, Wall Street wanted as many of these toxic mortgages as possible—because they could package them up and sell them for huge fees. The worse the loan, the higher the interest rate, the more money Wall Street made.

The bankers were in on every part of it. When they said something was worth a billion dollars, it was really only worth $57 million—a 17-to-1 ratio built on leverage and lies. When regulators tried to stop them, they replaced the regulators. When that didn’t work, they took over the government.

The hard work, hopes, and dreams of every American family sat on the surface of a balloon, endlessly expanding, until it couldn’t contain the air inside it anymore.

And the bankers knew it. They knew exactly when it would pop. They just wanted one more gorge before it did.

At the center of this feeding frenzy stood a bank named for Joseph A. Bear and Harold C. Mayer: Bear Stearns.

Born as an equity house in 1923, it earned its legendary reputation by somehow miraculously surviving the Great Depression. For 85 years it was the broker of note for some of the shadiest people in Manhattan. Donald Trump. Bear Stearns CEO Ace Greenberg was his personal banker. Robert Maxwell. Leslie Wexner. The Bronfmans. Jeffrey Epstein.

Bear Stearns—like Drexel Burnham Lambert before it—became the home of mortgage-backed securities that fed the 2000s housing boom. Goldman Sachs, Credit Suisse, JP Morgan, Deutsche Bank—all of them knowingly fed the frenzy. Everything about that boom was fraud. Liars’ loans. Predatory lending. A giant Ponzi scheme where the only way to keep it going was to keep feeding it new victims.

By 2007, it was clear the gorging was coming to an end.

The venerable 85-year-old Bear was clinging to life. But it wouldn’t go quietly. The titans of capitalism weren’t satisfied with decades of endless gorging, cannibalizing hard-working Americans piece by piece. They wanted their last pound of flesh.

And they had just the man to make that happen.