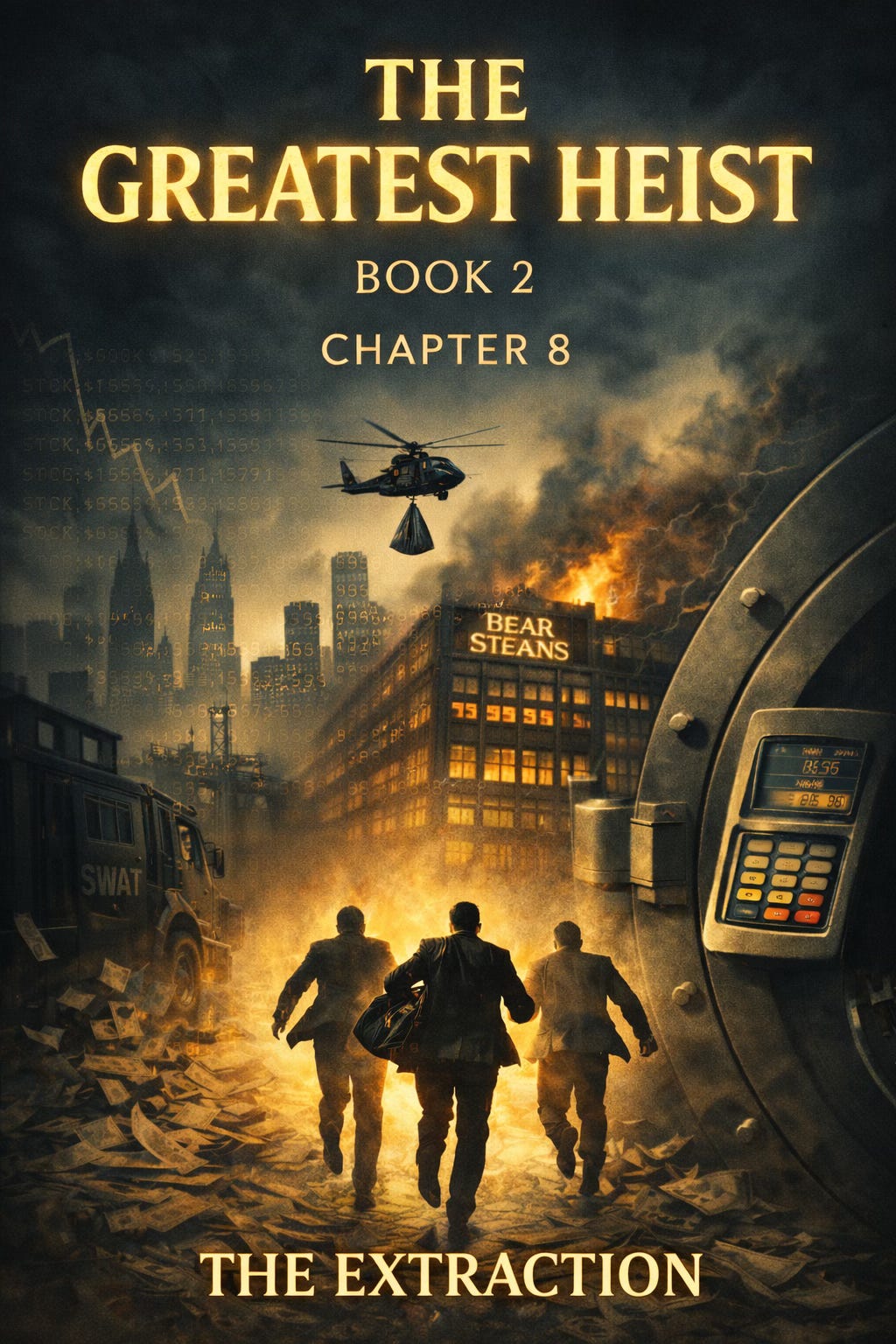

THE GREATEST HEIST BOOK 2 | Chapter 8 The Extraction

Trump went from $900M in debt to a net worth of $1.5B in a decade that included the 2008 crash—while his bank, his broker, and his former best friend ran the greatest extraction in history.

This was not their first time running a major hustle, but nothing had ever come close to this—not the crash of ‘87, not the dot-com bubble, not even 9/11. This was going to be the biggest, the most sophisticated scheme of them all. Everyone would walk away broken—except for this crew.

To understand the collapse of the economy, you have to go back to the fall of Bear Stearns, and even further, to December 2007. Donald Trump was riding high on the banks’ money, yet it seemed like every bank in America had blacklisted “Donald Risk.” His casinos were drowning in debt.

The 2000s were the heyday of criminality for a group of bankers who engineered the largest fraudulent scheme in history—a giant Ponzi structure built on liar loans, inflated ratings, and deliberate opacity. If you were on the outside, you lost everything. But if you had an inside track—like a relationship with Bear Stearns, where Ace Greenberg and Jimmy Cayne specialized in racking up clients such as Donald Trump with more debt than they could ever repay—you could ride the wave until the inevitable collapse.

But then—what would happen when the crash came? How would you keep your assets safe? You’d need a vault—and a mechanism to extract it while the rest of the economy collapsed around it.

That was Epstein’s specialty—offshore accounts, secrecy, and crisis engineering. He learned from legends like Robert Maxwell and Adnan Khashoggi. Epstein understood markets and patterns. He knew that being first in line for a bailout made you a priority—if your vault was buried inside the first company to collapse, your odds of survival rose exponentially. The real trick wasn’t just building the vault; it was timing the fall so the rescue came just in time.

Thursday, March 13, 2008

9:00 PM

Avra Restaurant, 48th Street, Manhattan

Jamie Dimon was soaking in his storied banking career at Avra on East 48th, surrounded by his family for his 52nd birthday. His twin brother Teddy was there. His wife Judy. His daughter Julia, and his parents—soaking in a specific type of Jewish parental pride: nachas.

Dimon’s phone vibrated. He thought about letting it go to voicemail, but this was not a call you could afford to ignore—even if you were Jamie Dimon.

He turned to Julia and apologized, then stepped outside into the brisk reality of New York in March.

Alan Schwartz. Bear Stearns CEO. Gone was the steady polish of a Wall Street lifer; in its place, desperation.

“I’m sorry to interrupt, but it’s important. It’s the firm. We’re in trouble.”

“Jamie, I need thirty billion dollars tonight, otherwise we’re going to go bankrupt in Asia in the morning.”

That’s a number that even Dimon coudln’t fathom.

“Alan, I don’t even know how to get thirty billion dollars.”

What happened in the next 72 hours—and who walked away with billions—is the story of the vault in action.

Subscribe to read the complete investigation.