The Greatest Heist: Chapter 5 - The Four Men Who Stole America

The $44.7 Trillion Crime That Robbed Every American Family of Their Millionaire Future

They called it "the Monday Massacre," an "absolute nightmare" that sent the Dow Jones into a "fear-fed free fall," dropping 508 points in a single day—October 19, 1987. Wave after wave of panicked selling hit Wall Street in what CBS called "a bloodbath" that wiped out $500 billion in investor wealth.

But while ordinary Americans watched their life savings evaporate, brokers’ phones melted down, and the stock market ticker struggled to keep up with the volume, a select group of insiders were capitalizing on the fear.

"One investor's crash is another's buying opportunity," the market vultures proclaimed.

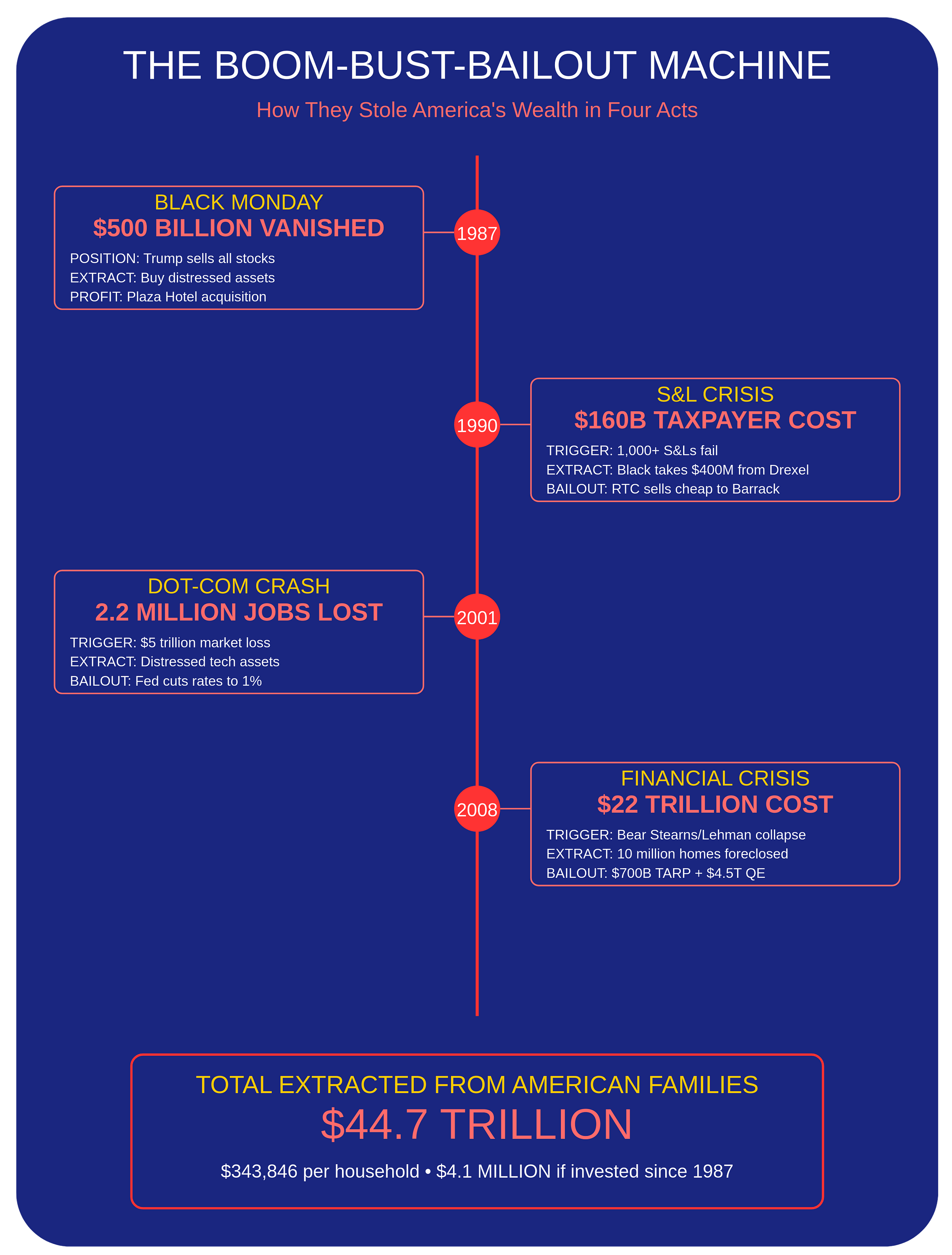

They weren't just profiting from the chaos—they had orchestrated it. This was the moment a $44.7 trillion extraction machine shifted into high gear, a systematic looting operation that would span four decades, destroy millions of American families, and elevate its architects to the highest levels of power.

Boom, Bust, Bailout

It's 9:30 AM on a Monday morning. Wall Street traders are settling in with their coffee when the impossible happens. The Dow Jones begins its death spiral—22.6% in a single day, the largest crash in stock market history. Wave after wave of selling hits the floor, but the traders are helpless to stop the carnage. The whole thing had been orchestrated beyond their reach—computer programs triggering automatic sells, offshore accounts positioned for the collapse, insiders already out. $500 billion vanishes. Pension funds collapse. Small investors lose everything. The traders work through lunch, desperately trying to stem the bleeding, but the future had already been determined by men who knew exactly what was coming.

But here's the thing about heists—while everyone else is panicking, the thieves are already positioned.

Four men claimed they saw it coming. Donald Trump told the Wall Street Journal he'd sold "all my stock" the month before. Jeffrey Epstein wasn't invested in stocks at all—he was running a different game entirely. Tom Barrack was buying distressed real estate, not stocks. Leon Black was extracting millions from Drexel Burnham Lambert while the junk bond market imploded.

The odds of four connected men all avoiding the crash by accident? Astronomical. The odds of them coordinating to trigger it? That's what the evidence shows.

The Shark in the Water

Here's where it gets sinister. They didn't just avoid the crash—they created the conditions that made it inevitable.

Michael Milken at Drexel Burnham Lambert had spent the 1980s pumping the entire American economy full of junk bonds. Every major corporation, real estate deal, and leveraged buyout became dependent on high-risk debt. It was financial heroin, and Milken was the dealer who got the whole country addicted.

Leon Black, as Milken's right-hand man, knew exactly which companies would collapse when the junk bond market died. But Black wasn't trying to save Drexel—he was systematically destroying it from within. While other executives scrambled to shore up the firm, Black extracted $15-16 million in bonuses during 1989-1990, the largest payouts as the company died.

When Drexel declared bankruptcy on February 13, 1990—the "Valentine's Day Massacre"—SEC documents show $400 million had been "moved out of the broker dealer in short space of time." Black walked away untouched and used that money to launch Apollo Global Management, becoming a billionaire by managing the distressed assets his own actions had created.

They built a financial weapon disguised as innovation, pumped the entire economy full of toxic debt, then detonated it from within while positioned to profit from the wreckage.

Never Leave A Paper Trail

Trump's $390 million Plaza Hotel purchase in March 1988 should have been impossible. Black Monday had frozen credit markets. Traditional banks weren't lending. Trump was already overleveraged from his casino construction. Yet somehow, he acquired Manhattan's crown jewel using entirely borrowed money.

Tom Barrack made it happen during the Black Monday crisis itself. Working for the Robert Bass Group, Barrack orchestrated what appears to have been a forced sale during the market chaos, completing the entire transaction in just 30 minutes and earning Bass $50 million. The timing was no coincidence—Barrack was positioned to exploit the panic, forcing the sale when traditional buyers couldn't access credit.

Abraham Wallach, Trump's "fixer" with 15+ arrests, conducted espionage operations from hidden rooms behind fake walls in the Plaza's Vanderbilt Suite. The hotel hosted arms dealer Adnan Khashoggi, the Iran-Contra figure who'd previously owned Trump's yacht. When Khashoggi attended Trump's 1993 wedding at the Plaza, it wasn't social—it was business.

The Plaza's finances revealed the true purpose. Trump bought the hotel from Barrack for $390 million using 100% borrowed money, creating impossible math from day one. By 1990, debt service alone cost $41 million annually while cash flow was only $21 million—a $20 million annual loss before operating expenses. By 1992, total debt had ballooned to $550-600 million.

The numbers made no sense for a hotel business, but perfect sense for what it actually was: operational infrastructure financed by other people's money.

When Trump filed the first bankruptcy in the Plaza's 85-year history, it wasn't failure—it was extraction methodology. The bankruptcy let Trump shed $250 million in debt forgiveness while keeping 51% ownership and remaining as ceremonial CEO. He had used other people's money to acquire Manhattan's crown jewel, extracted maximum value for four years, then wiped out most of the debt while retaining the asset.

Prince Al-Waleed bin Talal's 1995 bailout established something far more dangerous than financial rescue—it created an opening for Middle East nations to buy favor with Trump.

The pattern was now set: overleveraging on prestigious assets, using them as operational platforms, then accepting foreign bailouts to maintain control while others absorbed losses. Saudi money had bought influence over a future president, and the Plaza Hotel was where it began.

No Honor Among Thieves

Tom Barrack thought he was part of the team. In the early 1990s, Colony Capital had signed legitimate contracts to acquire Towers Financial, Steven Hoffenberg's $450 million Ponzi scheme. Barrack's deal would have saved the company and its investors.

Jeffrey Epstein had other plans.

According to Hoffenberg's testimony, "Tom Barrack signed the papers. The money was changed hands, the deal was made. And Epstein people" sabotaged the transaction. The legitimate acquisition was killed, and the company was handed to "his closest friend, John Hall," who "took that deal over from Tom Barrack through Jeffrey Epstein and stole all the money straight out of Towers Financial."

Epstein didn't just steal from investors—he stole from his own criminal partners. "That's how Jeffrey Epstein got the money out by rejecting that deal," Hoffenberg explained. The SEC and FBI have all the records.

Why could Epstein betray the network with impunity? Because he had protection they didn't know about.

Have Protection

When Towers Financial collapsed in 1993, only Hoffenberg went to prison. Epstein walked free with $450 million. Years later, Hoffenberg learned why.

"Alex Acosta said when he did the [Epstein] indictment... he said this was an intelligence case, not a criminal case," Hoffenberg revealed. "Now, in the Towers Financial criminal case, the same intelligence was taking place. That's why Epstein was not prosecuted."

The protection operated locally in New York City, bypassing federal oversight. While sophisticated criminals like Barrack, Black, and Milken operated within the system's constraints, Epstein had intelligence cover that made him untouchable.

This explains the $450 million pattern across multiple operations—all with Epstein as the mastermind:

Bear Stearns insider trading (1981): ~$450 million - Epstein's first extraction

Robert Maxwell's Mirror Group pension theft (1991): $450 million - Epstein's mentor's template

Drexel collapse (1990): $400 million extracted - Steven Hoffenberg confirmed to me that Epstein worked for Drexel and had a close relationship with Milken, though no paper trail exists

Pan Am bankruptcy (1991): ~$450 million extracted - Epstein served as "financial advisor familiar with Pan Am for approximately six years"

Towers Financial (1993): $450 million stolen - Hoffenberg confirmed Epstein was the "architect"

Every single collapse had Epstein's fingerprints. This wasn't profit-sharing among criminals—it was Epstein perfecting his systematic extraction methodology across multiple institutions, using intelligence protection while his partners faced prosecution or death.

Paid subscribers can get a deep dive into how the operation worked after the break This investigation is entirely funded by paid subscriptions. Please consider a subscription and fund the next chapter of The Greatest Heist.

Don’t Leave Anything On The Table

The most audacious phase came next. The same network that crashed the markets positioned themselves to profit from the cleanup—using taxpayer money.

Over 1,000 savings and loans failed, costing taxpayers $160+ billion. The government created the Resolution Trust Corporation to sell failed assets. Tom Barrack founded Colony Capital in 1991—perfectly timed to become the largest RTC buyer.

Backed by Qatar's ruling family and other Middle Eastern investors, Colony bought failed S&L properties for 10-20 cents on the dollar, achieving 50-80% returns. American taxpayers funded the bailout, then watched the assets get sold at fire-sale prices to the same network that caused the crisis.

The coordination was systematic:

1987: Black Monday crashes markets

1988: Trump acquires Plaza during credit freeze

1989-1991: S&L crisis accelerates

1990: Drexel collapses, taking more S&Ls

1991: Colony Capital founded to buy RTC assets

1993: Towers Financial collapses, Epstein escapes with $450 million

Each phase fed the next. The market crash created the S&L crisis. The S&L crisis created the fire-sale opportunities. The network was positioned for every phase because they triggered every phase.

Wash and Spin

The technical coordination happened through Bear Stearns, which connected every major extraction across three decades.

Epstein's 1976-1981 training provided the foundation. But the crucial revelation is that Bear Stearns—not Drexel—actually financed Trump's casino empire through junk bonds issued at 14% annual interest. Alan "Ace" Greenberg served as both Trump's investment banker and personal stockbroker, an extraordinary level of access.

When Trump wanted to buy stocks, he bypassed normal channels and "called up Alan Greenberg's office." This intimate relationship enabled the systematic coordination between Trump's operations and the broader network.

The 1981 insider trading operation involving Seagram's CEO Edgar Bronfman netted approximately $450 million and forced Epstein's resignation—though he was never prosecuted. This established the pattern: extract maximum value, escape through intelligence protection, maintain access to the same infrastructure for future operations.

When Bear Stearns collapsed in March 2008, it triggered a $29 billion taxpayer bailout that protected both Trump and Epstein's operations, revealing how deeply their criminal enterprises had penetrated American financial institutions.

Mirror Trading

By 2013, the methodology had evolved into industrial-scale extraction. Jeffrey Epstein opened accounts at Deutsche Bank on August 19, 2013—the exact same date the bank renewed its relationship with Donald Trump.

This wasn't coincidence. Rosemary Vrablic served as Trump's personal banker while Thomas Bowers managed Epstein's 40+ accounts in the same Private Wealth Management division. The bank was already under investigation for laundering $20 billion in Russian money through "mirror trading"—complex transactions that created parallel structures to extract value while maintaining surface legitimacy.

The Liquid Funding Ltd. bailout of 2008 represents the network's ultimate achievement. When Bear Stearns collapsed, Epstein's $6.7 billion offshore entity had its debts mysteriously "paid in full" by American taxpayers, with 60% of proceeds flowing to network participants.

American taxpayers unknowingly funded a $4.02 billion extraction from the very network that had compromised American financial institutions for decades.

The Perfect Crime Without A Paper Trail

The network's ultimate protection was their methodology: no written partnerships, no documented agreements, no paper trail connecting the systematic extractions.

Coordination operated through compromise rather than contract. Each participant possessed enough damaging information about others to ensure silence, while intelligence assets or corrupt prosecutors provided protection from prosecution. And if anyone stepped out of line, there was the blackmail evidence of the underage girls. This created a self-reinforcing system where betrayal meant mutual destruction—except for those with intelligence protection.

The boom-bust-bailout pattern reveals their core strategy: position for collapse, extract during chaos, profit from taxpayer bailouts. Each cycle transferred wealth from American institutions to offshore accounts while maintaining the appearance of market-driven outcomes.

This is what the Trump-Epstein network was truly about, Corrupting America from within. The heist that would metastasize corrupting American systems and its values.

The $5.7 Billion Heist

The documented extractions total over $5.7 billion across multiple operations, representing the largest systematic wealth transfer from American institutions to offshore accounts in American history.

But the true achievement wasn't financial—it was the successful penetration and compromise of American financial institutions, regulatory agencies, and political systems by foreign intelligence assets operating under the cover of legitimate business.

They didn't just steal money. They captured the system itself. And in so doing, they stole the American Dream.

The numbers tell the story of a generation destroyed: Only 17% of young adults can afford a starter home, with first-time buyers now 38 years old—a decade older than in 1991. Student debt exploded from $481 billion to $1.8 trillion, growing 89% faster than income. Real wages haven't moved since 1979 despite productivity gains of 60%. Nearly half of American households have zero retirement savings, forcing 19% of those over 65 to keep working—up from 11% in 1987. The promised generational wealth transfer is a myth—68% will come from the wealthiest 7% of families, with most inheritances under $50,000. Marriage rates for 25-34 year-olds collapsed from 59% to 39%. Birth rates fell below replacement level to 1.6 children per woman. An entire generation can't afford homes, can't pay off debt, can't retire, won't inherit, can't marry, can't have children—not because they failed, but because trillions were systematically extracted from their future.

The testament to their success now resides at 1600 Pennsylvania Ave. The conman who benefited from advanced positioning ahead of Black Monday, who built an empire on the backs of taxpayers and bailouts, has now captured the pinnacle of power, and his primary goal is to seal decades of criminality by suffocating the last breath of American freedom.

As we will continue to show you in chapter after chapter, the Trump-Epstein network carried out a criminal spree that spanned decades. Epstein crashing markets and Trump crashing casinos and real estate - each hiding billions in dirty money laundered through their operations. All carried out in concert with each other, but without a paper trail.

The true cost? $44.7 trillion stolen through direct extractions and systemic destruction. That's $343,846 per American household—money that, if invested at market rates since 1987, would be worth $4.1 million per family today. Every American family had their millionaire future stolen. Every time you see Trump gloating about his ostentatious wealth, remember: it was built with money stolen from you, in a scheme where the victims funded their own victimization through taxpayer bailouts.

And now with their full control over the DOJ and SEC, there is limited hope for any of these men being prosecuted or arrested, but in the ongoing shock and outrage over what Epstein did in concert with Trump, there is a glimmer of hope that the sheer scale of this massive crime spree could finally come home to roost.