Trump Family's Billion $ Crypto Gold Rush

While Americans lose healthcare and jobs, the Trumps are minting a fortune mostly from foreign crypto investors.

The numbers land like a slap: $864 million into Trump Organization coffers in the first half of 2025. That’s seventeen times what the family made in the same period a year earlier. Strip away the golf courses and real estate licensing deals—the traditional Trump money engines—and you’re left staring at something unprecedented. Over 90% of that windfall, some $802 million, flowed from cryptocurrency ventures that didn’t exist two years ago.

While 20 million Americans opened their Obamacare renewal notices this week to find 30% price increases and expiring subsidies, while Amazon and UPS announced mass layoffs, while 750,000 federal workers sit furloughed without pay—the president’s family has been on a global roadshow converting proximity to power into digital cash.

The pitch is simple. Eric and Don Jr., along with their younger brother Barron—yes, Barron Trump is listed as a co-founder of World Liberty Financial—have been selling governance tokens that offer buyers almost nothing beyond limited voting rights on a platform that doesn’t actually exist yet. The promised peer-to-peer lending system remains vaporware. The WLFI token trades at 14 cents, down 65% from its brief September peak.

But the Trump name opens wallets that due diligence would keep closed.

In Dubai this May, Eric Trump sat down with Guren “Bobby” Zhou, a Chinese businessman under investigation in Britain for money laundering. Chinese courts in three separate cases found Zhou and a family member failed to repay loans totaling $2.4 million. Weeks after that Dubai meeting, an entity Zhou is connected to announced a $100 million purchase of World Liberty tokens—sending roughly $75 million to the Trump family under the company’s distribution agreement.

Hong Kong crypto billionaire Justin Sun bought $75 million in tokens after the SEC charged him in 2023 with fraud and selling unregistered securities. The commission paused Sun’s case in February, weeks after he announced his massive token purchase. Last week, Trump pardoned him entirely. Sun’s response on social media: he would “do everything we can to help make America the Capital of Crypto.”

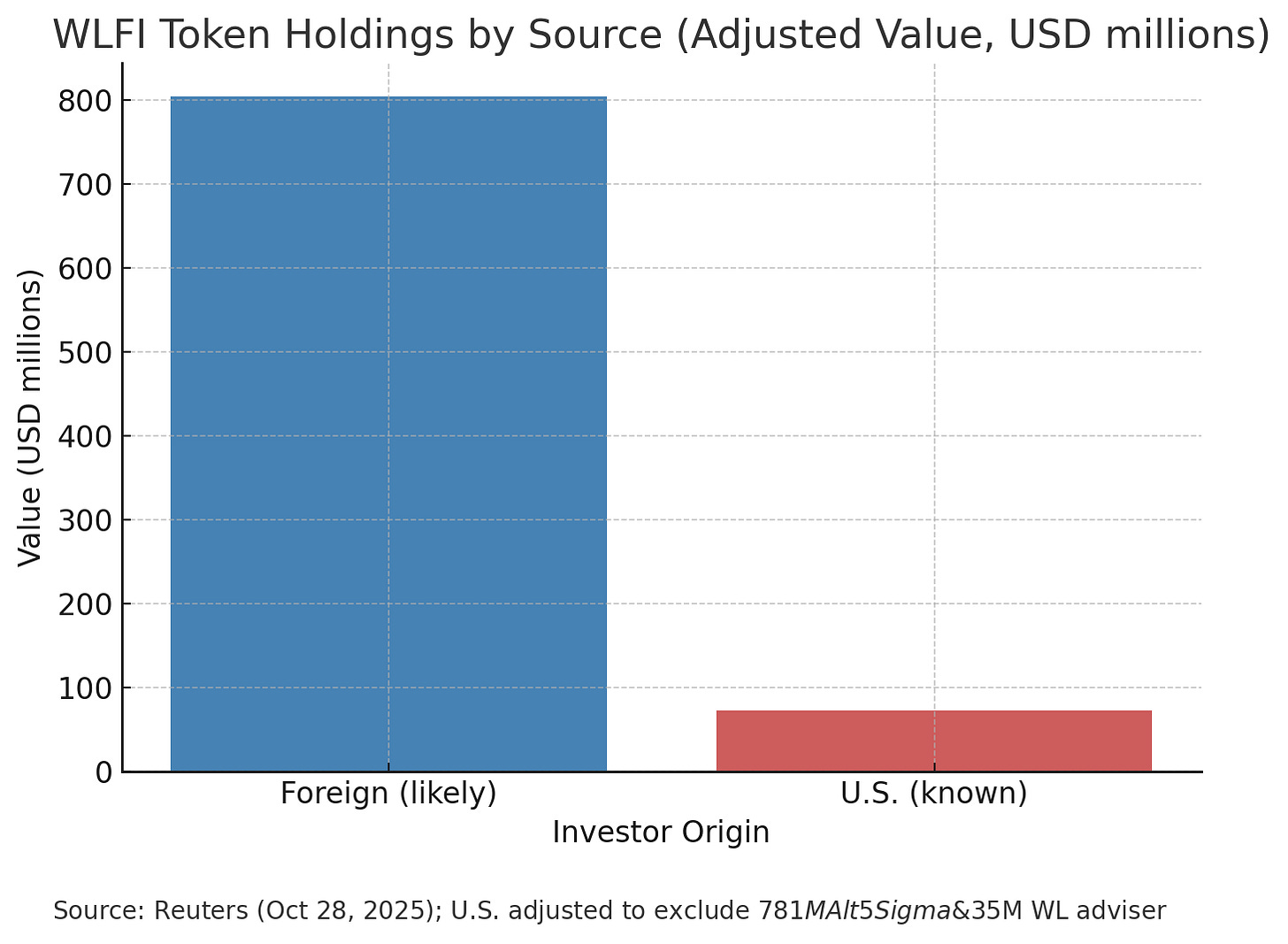

The foreign money isn’t subtle. A Reuters analysis of the 50 largest WLFI token holders found that 36 wallets—valued at $804 million—were likely connected to overseas buyers. Only four wallets traced to U.S. investors, and most of that was a single blockchain company’s bulk purchase.

Paid subscribers can access a deeper dive: